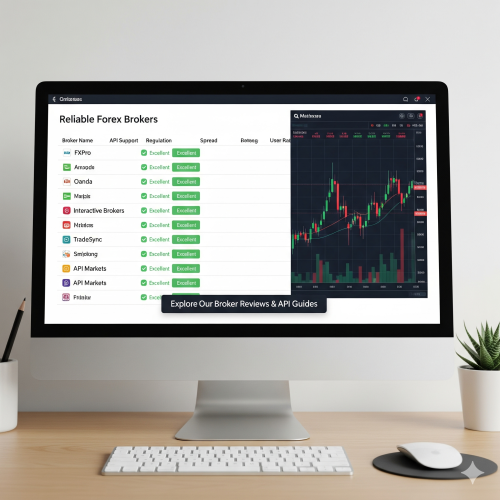

Finding a reliable forex broker with robust API support can feel like searching for a needle in a haystack. Trust me, I've been there – staring at endless broker comparison charts at 2 AM, wondering which one won't disappear with my money or crash during market volatility. The good news? After years of trading and countless API integrations, I've narrowed down the field to brokers that actually deliver on their promises.

Whether you're building automated trading systems, developing custom analysis tools, or just want seamless connectivity for your trading strategies, API quality can make or break your trading experience. Let's dive into what makes a forex broker truly reliable in today's fast-paced trading environment.

What Makes a Forex Broker API Actually Good?

Before we jump into specific brokers, let's talk about what separates the wheat from the chaff when it comes to forex APIs. It's not just about having an API – it's about having one that works when you need it most.

- Low latency execution with consistent response times under 50ms

- Comprehensive documentation that doesn't leave you guessing

- Real-time market data feeds that don't lag behind price movements

- Robust error handling and clear status codes

- Rate limiting that's reasonable for serious trading applications

- WebSocket support for streaming data without constant polling

These aren't just nice-to-haves – they're essential features that determine whether your trading bot makes money or burns through your account faster than you can say "margin call."

Top-Tier Brokers for API Trading

OANDA consistently ranks at the top for API reliability. Their REST API and streaming rates API have been battle-tested by thousands of developers. What I love about OANDA is their transparent pricing model and the fact that they don't play games with requotes during volatile market conditions. Their API documentation is actually readable (shocking, I know), and their sandbox environment lets you test strategies without risking real money.

Interactive Brokers (IBKR) offers one of the most comprehensive APIs in the business through their TWS API. Sure, it has a learning curve steeper than Mount Everest, but once you're up and running, you get access to multiple asset classes, not just forex. Their execution quality is top-notch, and they're regulated in multiple jurisdictions, which adds an extra layer of security.

IG Group has quietly built one of the better REST APIs in recent years. Their streaming prices come through WebSockets, and they offer both demo and live account APIs with identical functionality. What sets them apart is their extensive historical data access – perfect for backtesting strategies before going live.

Regional Considerations and Accessibility

Here's where things get tricky. Not all brokers welcome traders from every corner of the world. Some regions face restrictions due to local regulations or broker policies. The key is finding brokers that offer global accessibility while maintaining high API standards.

Pepperstone stands out for its inclusive approach to international clients. Their cTrader platform offers excellent API support with low-latency execution, and they're known for competitive spreads. Their MT4/MT5 APIs are solid, though I personally prefer their cTrader offering for serious algorithmic trading.

Forex.com (part of StoneX Group) provides robust API access through both MetaTrader and their proprietary platform. They're well-regulated and offer comprehensive market access. Their REST API handles order management beautifully, and their streaming data feeds are reliable even during major news events.

The best forex API isn't necessarily the most feature-rich one – it's the one that executes your trades reliably when milliseconds matter. I've seen traders lose more money from API downtime than from bad strategy decisions.

Personal Trading Experience

Essential API Features for Serious Trading

When evaluating forex broker APIs, certain features separate the professionals from the amateurs. Let's break down what you should actually care about:

- Order management with support for all major order types (market, limit, stop, OCO)

- Position sizing flexibility with proper risk management controls

- Historical data access spanning multiple timeframes and years of data

- Account information retrieval including margin calculations and P&L updates

- Real-time notifications for order fills, margin calls, and account events

Code Example: Basic Order Placement

Here's a simple example of how a well-designed forex API should handle order placement. This example uses a generic REST approach that most modern brokers follow:

import requests

import json

from datetime import datetime

class ForexAPI:

def __init__(self, api_key, account_id, base_url):

self.api_key = api_key

self.account_id = account_id

self.base_url = base_url

self.session = requests.Session()

self.session.headers.update({

'Authorization': f'Bearer {api_key}',

'Content-Type': 'application/json'

})

def place_market_order(self, instrument, units, side='buy'):

"""Place a market order with basic error handling"""

endpoint = f"{self.base_url}/accounts/{self.account_id}/orders"

order_data = {

'order': {

'type': 'MARKET',

'instrument': instrument,

'units': str(units) if side == 'buy' else str(-units),

'timeInForce': 'FOK', # Fill or Kill

'positionFill': 'DEFAULT'

}

}

try:

response = self.session.post(endpoint, json=order_data)

response.raise_for_status()

result = response.json()

if 'orderFillTransaction' in result:

fill_price = result['orderFillTransaction']['price']

trade_id = result['orderFillTransaction']['tradeOpened']['tradeID']

return {

'success': True,

'trade_id': trade_id,

'fill_price': fill_price,

'timestamp': datetime.now().isoformat()

}

else:

return {'success': False, 'error': 'Order not filled'}

except requests.exceptions.RequestException as e:

return {'success': False, 'error': str(e)}

def get_account_summary(self):

"""Retrieve current account balance and open positions"""

endpoint = f"{self.base_url}/accounts/{self.account_id}/summary"

try:

response = self.session.get(endpoint)

response.raise_for_status()

data = response.json()

return {

'balance': float(data['account']['balance']),

'unrealized_pl': float(data['account']['unrealizedPL']),

'margin_used': float(data['account']['marginUsed']),

'margin_available': float(data['account']['marginAvailable'])

}

except requests.exceptions.RequestException as e:

return {'error': str(e)}

# Usage example

api = ForexAPI(

api_key='your-api-key-here',

account_id='101-004-123456-001',

base_url='https://api-fxtrade.oanda.com/v3'

)

# Place a small EUR/USD buy order

result = api.place_market_order('EUR_USD', 1000, 'buy')

if result['success']:

print(f"Order filled at {result['fill_price']}")

else:

print(f"Order failed: {result['error']}")

# Check account status

account_info = api.get_account_summary()

print(f"Account balance: ${account_info.get('balance', 'N/A')}")

Testing and Development Best Practices

Before you risk real money with any broker's API, spend serious time in their sandbox environment. I can't stress this enough – every broker implements standards slightly differently, and those small differences can cost you big money in live trading.

Start with paper trading, implement proper logging for all API calls, and always have fallback plans for when (not if) the API goes down during important market events. The best traders I know have multiple broker accounts specifically to hedge against API outages.

Security and Risk Management

API keys are like passwords to your money. Treat them accordingly. Never hardcode them in your source code, use environment variables, and regularly rotate your keys. Most professional brokers offer role-based API permissions – use them to limit potential damage if your keys are compromised.

- Store API keys in secure environment variables or key management systems

- Implement proper rate limiting to avoid hitting API thresholds

- Use read-only keys for data analysis and separate keys for trading

- Monitor API usage patterns to detect unusual activity

- Always validate data before placing trades – trust but verify

The forex market never sleeps, and neither should your vigilance when it comes to API security. A compromised trading bot can drain an account faster than you can react, especially if you're sleeping while your algorithm is running wild.

Looking Ahead: The Future of Forex APIs

The forex API landscape continues evolving rapidly. We're seeing more brokers adopt GraphQL for flexible data queries, WebSocket implementations for ultra-low latency feeds, and better integration with cloud platforms for scalable trading operations.

Machine learning integration is becoming standard, with brokers offering sentiment analysis, news parsing, and pattern recognition directly through their APIs. It's an exciting time to be building trading systems, but the fundamentals remain the same: reliable execution, transparent pricing, and robust risk management.

Remember, the flashiest API features won't save you from a broker that plays fast and loose with regulations or client funds. Always prioritize regulatory compliance and financial stability over fancy technical features. Your future self will thank you when the next market crisis hits and your broker is still standing while others have vanished into the regulatory sunset.

The world of algorithmic forex trading is more accessible now than ever before, but success still requires combining solid technology with sound trading principles. Choose your broker wisely, test thoroughly, and never risk more than you can afford to lose – because in forex trading, even the best APIs can't guarantee profits.

Kirbywhopy

В этой публикации мы предлагаем подробные объяснения по актуальным вопросам, чтобы помочь читателям глубже понять их. Четкость и структурированность материала сделают его удобным для усвоения и применения в повседневной жизни. Узнать больше - https://vivod-iz-zapoya-1.ru/

Kirbywhopy

В этом информативном тексте представлены захватывающие события и факты, которые заставят вас задуматься. Мы обращаем внимание на важные моменты, которые часто остаются незамеченными, и предлагаем новые перспективы на привычные вещи. Подготовьтесь к тому, чтобы быть поглощенным увлекательными рассказами! Получить дополнительную информацию - https://vivod-iz-zapoya-1.ru/

CharlesDiarl

В этом обзорном материале представлены увлекательные детали, которые находят отражение в различных аспектах жизни. Мы исследуем непонятные и интересные моменты, позволяя читателю увидеть картину целиком. Погрузитесь в мир знаний и удивительных открытий! Получить дополнительные сведения - https://quick-vyvod-iz-zapoya-1.ru/

CharlesDiarl

Этот интересный отчет представляет собой сборник полезных фактов, касающихся актуальных тем. Мы проанализируем данные, чтобы вы могли сделать обоснованные выводы. Читайте, чтобы узнать больше о последних трендах и значимых событиях! Получить дополнительные сведения - https://quick-vyvod-iz-zapoya-1.ru/