So you've heard about ByBit and you're thinking about diving into the world of cryptocurrency trading? Well, you've come to the right place. ByBit has become one of the most popular crypto exchanges out there, and honestly, it's not hard to see why. The platform's got a solid reputation, decent fees, and a user interface that doesn't make you want to pull your hair out (trust me, that's rarer than you'd think in crypto).

Let me walk you through everything you need to know to get started with ByBit. I'll keep it real with you – there's no sugarcoating here. Trading crypto can be exciting, but it's also risky as hell, so we'll cover both the good stuff and the things you should definitely watch out for.

What Exactly Is ByBit?

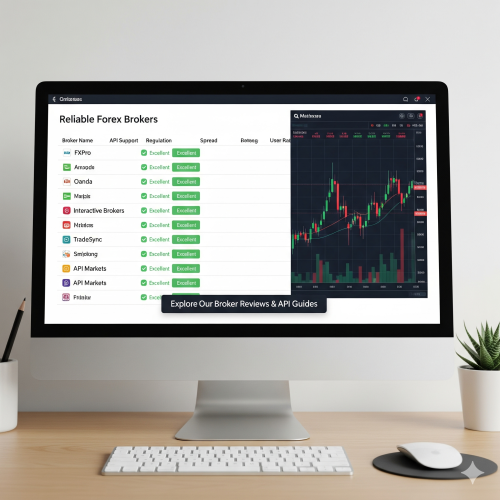

ByBit is a cryptocurrency derivatives exchange that launched back in 2018. Think of it as a platform where you can trade Bitcoin, Ethereum, and other cryptocurrencies, but with a twist – you're not just buying and selling the actual coins. Instead, you're trading contracts that derive their value from these cryptocurrencies.

The company's based in Singapore now (they moved from the British Virgin Islands), and they've managed to build up a pretty solid user base of over 10 million traders worldwide. What sets ByBit apart from some other exchanges is their focus on derivatives trading, particularly perpetual contracts and futures.

Getting Your Account Set Up

Alright, let's get down to business. Setting up your ByBit account is pretty straightforward, but there are a few things you should know before you start:

- You'll need a valid email address (obviously)

- Phone verification is required for most features

- KYC (Know Your Customer) verification isn't mandatory for basic trading, but it's recommended

- You can start with as little as $10, but honestly, you'll want more if you're serious about trading

Head over to ByBit's website and hit that "Sign Up" button. Enter your email, create a strong password (and I mean strong – use a password manager if you have to), and you're on your way. They'll send you a verification email, so check your inbox and click that link.

Understanding the Different Trading Options

This is where things get interesting. ByBit offers several different ways to trade, and each one has its own risk profile. Let me break them down for you:

Spot Trading: This is the most straightforward option. You're buying and selling actual cryptocurrencies. If you buy 1 Bitcoin, you own 1 Bitcoin. Simple as that. The risk here is pretty much what you'd expect – if Bitcoin's price goes down, you lose money.

Derivatives Trading: This is where ByBit really shines, but it's also where things get more complicated. You're not buying the actual cryptocurrency; instead, you're trading contracts based on the price movements. This includes perpetual contracts and futures contracts.

Copy Trading: If you're not confident in your own trading skills (and honestly, most beginners shouldn't be), you can copy the trades of more experienced traders. It's like having a mentor, except they don't know they're mentoring you.

Remember, derivatives trading can amplify both your gains and your losses. What I mean is, you could make 10x your money, but you could also lose 10x your money just as easily. It's not a game – treat it with the respect it deserves.

Anonymous Experienced Trader

Funding Your Account

Before you can start trading, you need to get some money into your ByBit account. The platform supports several deposit methods, though the options might vary depending on where you're located.

The most common way is to deposit cryptocurrency from another exchange or wallet. ByBit supports major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and several others. If you don't already own crypto, you'll need to buy some from another exchange first – think of Coinbase, Binance, or Kraken.

Some regions also support fiat deposits (that's regular money like USD or EUR) through third-party payment processors. The fees for these can be a bit higher, but it's convenient if you're just starting out.

Navigating the Trading Interface

When you first log into ByBit, the interface might seem a bit overwhelming. There are charts everywhere, numbers flying around, and buttons that you're not sure you should click. Don't worry – everyone feels this way at first.

The main trading interface is divided into several sections. You've got your price chart in the center (this shows how the price has moved over time), your order book on the right (showing current buy and sell orders), and your trading panel usually at the bottom or side where you can place your own orders.

- Start with the spot trading interface – it's the most straightforward

- Get familiar with market orders vs limit orders

- Learn to read the basic charts before diving into advanced technical analysis

- Practice with small amounts first – think of it as paying for education

- Use the demo trading feature if available to get a feel for the platform

Risk Management: This Is Crucial

Look, I'm going to be straight with you here. Most people who start trading cryptocurrency lose money. That's not to scare you away, but it's the reality. The key to being in the minority that actually makes money is proper risk management.

First rule: never invest more than you can afford to lose. I know everyone says this, but I mean it. If losing your trading capital would affect your ability to pay rent, buy groceries, or handle an emergency, you shouldn't be trading with that money.

Second rule: use stop losses. These are orders that automatically sell your position if the price moves against you by a certain amount. Yeah, it might feel bad to take a small loss, but it's better than taking a huge loss.

Third rule: don't put all your eggs in one basket. Diversify your trades across different cryptocurrencies and different types of trades. If one goes bad, the others might offset the losses.

Understanding Fees and Costs

ByBit's fee structure is actually pretty competitive compared to other exchanges, but you still need to understand what you're paying for. There are trading fees, withdrawal fees, and sometimes funding fees for certain types of trades.

Trading fees are usually a small percentage of your trade size – typically around 0.1% for spot trading and can vary for derivatives. These might seem small, but they add up quickly if you're trading frequently.

Withdrawal fees depend on which cryptocurrency you're withdrawing. Bitcoin withdrawals usually cost more than stablecoin withdrawals due to network fees.

For derivatives trading, there are also funding fees that occur every 8 hours. These can either cost you money or make you money, depending on which side of the trade you're on and market conditions.

Security: Protecting Your Investment

Cryptocurrency exchanges have been hacked before, and they'll probably be hacked again in the future. While ByBit has a good security record and uses industry-standard protection measures, you should still take steps to protect yourself.

Enable two-factor authentication (2FA) immediately. This adds an extra layer of security to your account. Use an authenticator app like Google Authenticator or Authy rather than SMS if possible – it's more secure.

Don't keep large amounts of cryptocurrency on any exchange for extended periods. Think of exchanges like your wallet – you carry some cash in your wallet for daily expenses, but you don't keep your life savings there. Same principle applies here.

Be wary of phishing attempts. Always type ByBit's URL directly into your browser or use a bookmark. Never click on links in emails claiming to be from ByBit without verifying them first.

Learning Resources and Tools

ByBit actually provides quite a few educational resources, which is great for beginners. They have a learning center with articles covering basic trading concepts, technical analysis, and risk management. Take advantage of these – they're free and can save you from making expensive mistakes.

The platform also offers various tools to help with your trading. There are different chart types, technical indicators, and analysis tools. Don't feel like you need to use all of them right away. Start with the basics and gradually add more complex tools as you gain experience.

Many successful traders also recommend keeping a trading journal. Record your trades, why you made them, and how they turned out. This helps you identify patterns in your trading behavior and learn from both your successes and mistakes.

Common Mistakes to Avoid

Let me share some of the most common mistakes I see beginners make, so you can hopefully avoid them:

FOMO (Fear of Missing Out) is huge in crypto trading. You see a coin pumping and think you need to jump in immediately. More often than not, by the time you notice the pump, it's already too late. Don't chase pumps.

Overleveraging is another big one, especially on derivatives. Just because you can use 100x leverage doesn't mean you should. Higher leverage means higher risk, and it can wipe out your account faster than you can blink.

Emotional trading is probably the biggest account killer. Making decisions based on fear or greed rather than logic and strategy. If you find yourself getting emotional about trades, take a step back and maybe take a break.

Not having a plan is also common. Don't just wing it. Have a strategy, stick to it, and adjust it based on results and changing market conditions.

Getting Support When You Need It

ByBit offers customer support through several channels. They have a live chat feature on their website, email support, and a pretty comprehensive FAQ section. Response times are usually decent, though they can be slower during periods of high market volatility when everyone's having issues.

They also have an active community on social media platforms like Twitter and Telegram where you can get help from other users. Just be careful about who you trust – there are scammers in these communities too.

If you're having technical issues with the platform, try clearing your browser cache first or switching to a different browser. A surprising number of issues can be resolved this way.

Final Thoughts

Starting with ByBit can be exciting, but remember that successful trading takes time, patience, and continuous learning. Don't expect to become profitable overnight – most successful traders spent months or even years developing their skills.

Start small, learn the basics, and gradually increase your trading size as you gain experience and confidence. Focus on risk management over profits, and always remember that preservation of capital is more important than making huge gains.

The cryptocurrency market never sleeps, which means there will always be opportunities. Don't feel like you need to catch every movement or trade every day. Sometimes the best trade is no trade at all.

And finally, stay informed about market developments, regulatory changes, and new features on the platform. The crypto space moves fast, and staying up-to-date will help you make better trading decisions.

Good luck with your trading journey, and remember – only invest what you can afford to lose. The crypto market can be rewarding, but it's also unforgiving to those who don't respect its risks.

0 Comment