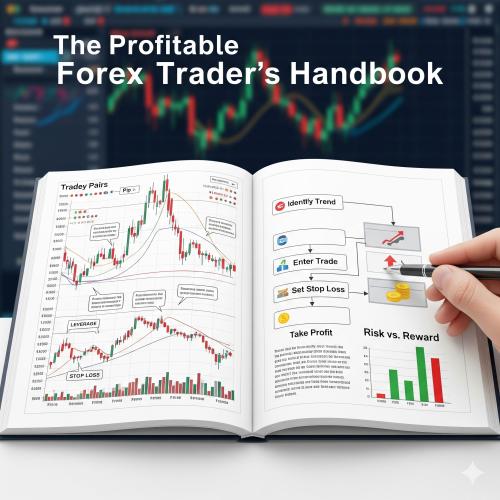

So you've heard about forex trading and you're curious about dipping your toes into the world's largest financial market? Well, you're not alone. Every day, millions of people trade currencies worth over $6 trillion globally. But here's the thing - while forex can be incredibly rewarding, it's also a place where many beginners lose their shirts because they jump in without proper preparation.

I remember when I first started looking into forex trading about five years ago. I was working a regular 9-to-5 job and kept hearing stories about people making thousands from their laptops. Sounds pretty appealing, right? But after doing some research and making plenty of mistakes along the way, I learned that successful forex trading isn't about get-rich-quick schemes - it's about understanding the market, managing risk, and developing a solid strategy.

What Exactly Is Forex Trading?

Before we dive into the how-to stuff, let's make sure we're on the same page about what forex actually is. Forex (short for foreign exchange) is basically the process of buying and selling currencies. When you travel abroad and exchange your dollars for euros, you're participating in the forex market - just on a much smaller scale.

In forex trading, you're always trading currency pairs. For example, EUR/USD means you're looking at the euro against the US dollar. If you think the euro will strengthen against the dollar, you'd buy EUR/USD. If you think it'll weaken, you'd sell it. Pretty straightforward concept, but the execution? That's where things get interesting.

Setting Up Your Trading Foundation

Alright, so you're convinced that forex might be worth exploring. The first thing you need to do is educate yourself properly. And I don't mean watching a few YouTube videos and calling it a day. You need to understand concepts like:

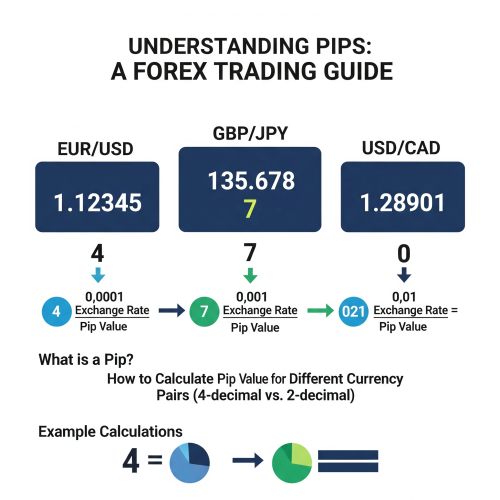

- Currency pairs and how they work (major, minor, and exotic pairs)

- Pips, spreads, and leverage - these will determine your profits and losses

- Market sessions (London, New York, Tokyo, Sydney) and when they overlap

- Economic indicators that move currency prices

- Different trading styles like scalping, day trading, and swing trading

There are tons of free resources online, but I'd recommend starting with some solid educational platforms like BabyPips or Investopedia. These sites break down complex concepts into digestible chunks without overwhelming you with jargon.

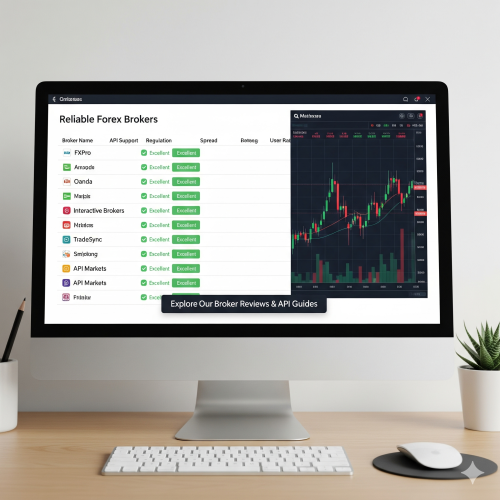

Choosing Your Broker Wisely

This is huge, and honestly, it's where a lot of people mess up right from the start. Not all brokers are created equal, and picking the wrong one can seriously impact your trading journey. Here's what you should look for:

First, make sure they're properly regulated. In the US, look for CFTC and NFA regulation. In the UK, it's the FCA. Other countries have their own regulatory bodies, but the point is - don't trade with unregulated brokers, no matter how attractive their offers might seem.

Next, consider the spreads and commissions. Some brokers advertise zero commissions but make their money through wider spreads. Others charge commissions but offer tighter spreads. Do the math and see which structure works better for your trading style.

The best broker isn't necessarily the one with the flashiest marketing or the most attractive bonuses. It's the one that offers reliable execution, fair pricing, and solid customer support when things go wrong.

Personal experience from 5 years of trading

Also, test their platform thoroughly on a demo account before committing real money. Is it user-friendly? Does it have all the tools you need? How's the mobile app? These might seem like minor details, but when you're trying to close a position quickly and the platform freezes, you'll understand why this matters.

Demo Trading: Your Safety Net

I can't stress this enough - spend at least a few months trading on a demo account before you risk real money. I know it's tempting to jump straight into live trading, especially when you're having success on demo, but trust me on this one.

Demo trading lets you practice without the emotional pressure of losing actual money. You can test different strategies, get familiar with your trading platform, and most importantly, make mistakes without paying for them. The psychological aspect of trading real money is completely different from demo trading, but you need to master the technical side first.

Understanding Risk Management (This Could Save Your Account)

Here's something that took me way too long to learn properly: risk management is more important than finding winning trades. I've seen traders with 80% win rates blow their accounts because they didn't manage their risk properly on the losing trades.

The golden rule that most professionals follow is never risk more than 1-2% of your account on a single trade. So if you have $1,000 in your account, you shouldn't risk more than $10-20 per trade. I know this might seem conservative, especially when you're eager to make money quickly, but this approach will keep you in the game long enough to actually become profitable.

Position sizing goes hand in hand with risk management. You need to calculate your position size based on your stop loss and risk percentage. There are plenty of position size calculators online that can help you with this math, but here's a simple formula:

Position Size = (Account Size × Risk Percentage) ÷ (Stop Loss in Pips × Pip Value)

Always, and I mean always, use stop losses. A stop loss is basically your exit strategy when things go wrong. It automatically closes your position when the price moves against you by a certain amount. Without stop losses, a few bad trades can wipe out months of profits.

Developing Your Trading Strategy

Now we're getting to the fun part - actually developing a strategy for making money. There are countless approaches to forex trading, but as a beginner, I'd suggest starting with something relatively simple and proven.

Technical analysis is probably the most popular approach among retail traders. This involves studying price charts and using indicators to predict future price movements. Some popular strategies include:

- Trend following - riding the momentum when currencies are moving strongly in one direction

- Support and resistance trading - buying at support levels and selling at resistance levels

- Moving average crossovers - using the intersection of different moving averages as trading signals

- RSI divergence - looking for discrepancies between price action and the RSI indicator

Fundamental analysis is another approach where you focus on economic factors that drive currency values. This includes things like interest rate decisions, employment data, GDP growth, and political events. While this approach can be very profitable, it requires a deep understanding of economics and global politics.

My advice? Start with technical analysis because it's more straightforward for beginners, but always keep an eye on major economic events that could impact your trades. Most trading platforms provide economic calendars that show when important announcements are scheduled.

The Psychology Game: Managing Your Emotions

This is probably the hardest part of forex trading, and it's something that textbooks and courses don't really prepare you for. When you're trading with real money, emotions like fear, greed, and hope can completely derail your strategy.

I remember my first big losing trade. I was up about $200 on a EUR/USD position and got greedy, thinking it would keep going up. Instead of taking my profit, I held on and watched it turn into a $150 loss. The emotional roller coaster was intense, and it took me weeks to get back to trading objectively.

Here are some tips that have helped me manage trading psychology over the years:

- Stick to your trading plan no matter what - don't make emotional decisions in the heat of the moment

- Keep a trading journal to track not just your trades, but also your emotions and thought processes

- Take regular breaks from trading, especially after big wins or losses

- Start with small position sizes until you're comfortable with the emotional aspects

- Don't revenge trade - if you have a bad day, step away from the charts

Common Beginner Mistakes to Avoid

Let me share some of the biggest mistakes I made when I was starting out, so hopefully you can avoid them:

Overleveraging is probably the number one account killer for beginners. Just because your broker offers 100:1 or even 500:1 leverage doesn't mean you should use it. High leverage amplifies both profits and losses, and it's very easy to blow your account with just a few bad trades.

Trading without a plan is another big one. You need to know exactly when you'll enter a trade, where you'll place your stop loss, and where you'll take profits before you even click the buy or sell button. Trading based on gut feelings or tips from random internet forums is a recipe for disaster.

Trying to trade too many pairs at once is also common among beginners. It's better to focus on 1-2 currency pairs and really understand how they move rather than trying to monitor 10 different pairs simultaneously.

The market will always be there tomorrow. Don't feel like you need to be in a trade every minute of every day. Sometimes the best trade is no trade at all.

Advice that took me way too long to follow

Building Your Trading Routine

Successful forex trading isn't just about making good individual trades - it's about developing consistent habits and routines that support your long-term success.

Start each trading day by checking your economic calendar for any major news events. Some traders avoid trading during high-impact news releases because the volatility can be unpredictable, while others specifically target these events. Figure out what works for your strategy and stick to it.

Review your open positions and check if your thesis for each trade is still valid. Markets can change overnight, especially in forex since it trades 24 hours a day during weekdays. What looked like a great setup yesterday might not make sense anymore.

Keep detailed records of all your trades. Include not just the entry and exit points, but also your reasoning for the trade, the market conditions at the time, and how you felt during the trade. This journal will become invaluable as you refine your strategy over time.

Moving Forward: Your Next Steps

Alright, so where do you go from here? First, don't rush into anything. Take your time to absorb all this information and start with the basics. Open a demo account with a reputable broker and start practicing. Spend at least a few hours each week studying market analysis and economic concepts.

Join some forex communities online, but be careful about who you listen to. There are a lot of people selling courses and systems that promise unrealistic returns. Look for traders who are transparent about their losses as well as their wins, and who emphasize proper risk management.

Consider starting with a very small live account once you're consistently profitable on demo. The psychological difference between demo and live trading is significant, but the financial impact should be minimal while you're learning to handle real money emotions.

Most importantly, be patient with yourself. Forex trading is a skill that takes time to develop. There's no magic formula or secret strategy that will make you rich overnight. But with proper education, disciplined risk management, and realistic expectations, it can become a valuable skill that serves you for years to come.

Remember, every successful trader was once a beginner who made mistakes and learned from them. The key is to make sure your mistakes are small enough that you can recover from them and continue learning. Good luck on your forex trading journey - it's going to be quite the ride!

0 Comment