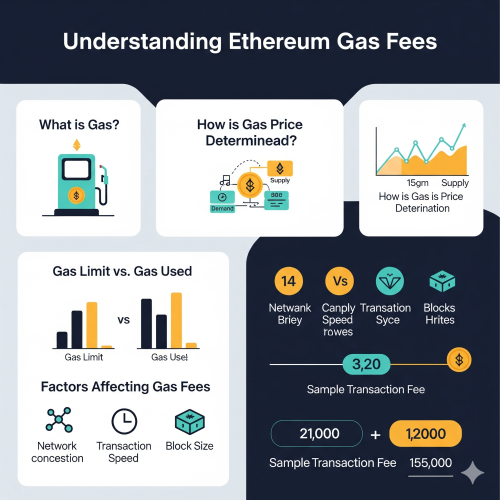

If you've been in the crypto space for more than five minutes, you've probably heard someone complaining about Ethereum gas fees. I remember paying $50 just to swap $100 worth of tokens back in 2021. That's when I realized we desperately needed better scaling solutions, and that's exactly what Layer 2s promised to deliver.

Layer 2 solutions aren't just some fancy marketing term - they're actually reshaping how we interact with blockchain networks. Today, we're diving deep into the three heavyweights: Arbitrum, Optimism, and zkSync. Each takes a different approach to solving Ethereum's scalability trilemma, and honestly, the technical differences are pretty fascinating once you get into them.

What Exactly Are Layer 2 Solutions?

Think of Layer 2s as express lanes on a busy highway. Ethereum mainnet is like that congested main road where everyone's stuck in traffic, paying premium prices for gas. Layer 2s build additional lanes that process transactions faster and cheaper, then periodically report back to the main chain.

The magic happens through various rollup technologies. Instead of processing every single transaction on Ethereum mainnet, these solutions bundle hundreds or thousands of transactions together, process them off-chain, then submit a compressed proof back to Layer 1. This dramatically reduces costs while maintaining the security guarantees of the underlying blockchain.

Arbitrum: The Optimistic Rollup Pioneer

Arbitrum launched with a simple premise: assume transactions are valid unless proven otherwise. This "optimistic" approach means faster processing times, but there's a catch - there's a dispute period where anyone can challenge a transaction if they think it's fraudulent.

What makes Arbitrum particularly interesting is their multi-round fraud proof system. Instead of having to replay entire transactions on-chain (which would be expensive), they use a clever bisection protocol that narrows down exactly where the dispute occurred.

- Uses optimistic rollup technology with 7-day withdrawal period

- Compatible with existing Ethereum tooling and smart contracts

- Implements multi-round fraud proofs for efficient dispute resolution

- Offers Arbitrum One (mainnet) and Arbitrum Nova (gaming/social)

- Supports custom gas tokens and has its own governance token (ARB)

// Arbitrum smart contract deployment example

// No special modifications needed - just deploy to Arbitrum network

contract SimpleStorage {

uint256 private storedData;

event ValueChanged(uint256 newValue, address indexed changer);

constructor(uint256 initialValue) {

storedData = initialValue;

}

function set(uint256 newValue) public {

storedData = newValue;

emit ValueChanged(newValue, msg.sender);

}

function get() public view returns (uint256) {

return storedData;

}

// Gas costs on Arbitrum are typically 90-95% lower than mainnet

function batchUpdate(uint256[] calldata values) external {

for(uint i = 0; i < values.length; i++) {

storedData = values[i];

emit ValueChanged(values[i], msg.sender);

}

}

}

// Bridge interaction for moving tokens from L1 to L2

interface IInbox {

function createRetryableTicket(

address to,

uint256 l2CallValue,

uint256 maxSubmissionCost,

address excessFeeRefundAddress,

address callValueRefundAddress,

uint256 gasLimit,

uint256 maxFeePerGas,

bytes calldata data

) external payable returns (uint256);

}The developer experience on Arbitrum is pretty seamless. You literally take your existing Ethereum contract, deploy it to Arbitrum, and boom - you're getting 90-95% gas savings. No code changes required, which is why it became so popular among DeFi protocols.

Optimism: Building for the Collective

Optimism took a slightly different approach. While technically similar to Arbitrum (both are optimistic rollups), Optimism focused heavily on governance and public goods funding. Their "Optimistic Vision" isn't just about scaling - it's about creating a sustainable ecosystem.

One thing that sets Optimism apart is their focus on retroactive public goods funding. They allocate a significant portion of their token supply to funding projects that benefit the broader Ethereum ecosystem. It's pretty cool to see a scaling solution thinking beyond just technical metrics.

The goal isn't just to make Ethereum faster and cheaper. We want to create an ecosystem where public goods are properly funded and innovation is rewarded retroactively based on impact, not just speculation.

Optimism Collective

- Implements single-round fraud proofs for simpler dispute resolution

- Features retroactive public goods funding through OP token rewards

- Offers the Optimism Collective governance model with Token House and Citizens' House

- Provides OP Stack for building custom rollup chains

- Plans transition to fault proofs for enhanced decentralization

// Optimism-specific features: Cross-chain messaging

contract L1Contract {

address public l2Contract;

// Send message from L1 to L2

function sendMessageToL2(string memory message) public {

ICrossDomainMessenger messenger = ICrossDomainMessenger(0x5086d1eEF304eb5284A0f6720f79403b4e9bE294);

messenger.sendMessage(

l2Contract,

abi.encodeWithSignature("receiveFromL1(string)", message),

200000 // gas limit for L2 execution

);

}

}

contract L2Contract {

address public l1Contract;

string public lastMessage;

// Receive message from L1

function receiveFromL1(string memory message) public {

ICrossDomainMessenger messenger = ICrossDomainMessenger(0x4200000000000000000000000000000000000007);

require(

msg.sender == address(messenger) &&

messenger.xDomainMessageSender() == l1Contract,

"Only L1 contract can call this"

);

lastMessage = message;

}

// Send message back to L1

function sendMessageToL1(string memory response) public {

ICrossDomainMessenger messenger = ICrossDomainMessenger(0x4200000000000000000000000000000000000007);

messenger.sendMessage(

l1Contract,

abi.encodeWithSignature("receiveFromL2(string)", response),

200000

);

}

}What's particularly interesting about Optimism is their OP Stack - essentially a blueprint for building your own rollup chain. Base (by Coinbase) is probably the most successful example of this, but we're seeing more OP Stack chains launch regularly. It's like franchising, but for blockchains.

zkSync: The Zero-Knowledge Revolution

Now this is where things get really technical and exciting. While Arbitrum and Optimism use optimistic rollups (assume valid, prove if fraud), zkSync uses zero-knowledge proofs to mathematically prove that every transaction is valid before it's accepted.

The advantage? No waiting periods for withdrawals. When you want to move funds back to Ethereum mainnet, you don't need to wait 7 days for potential challenges - the math has already proven everything is legitimate.

zkSync Era: Technical Deep Dive

zkSync Era (their latest version) introduces some genuinely innovative features. They've built their own zkEVM (zero-knowledge Ethereum Virtual Machine) that can execute regular Solidity smart contracts while generating zero-knowledge proofs.

- Uses zk-STARK proofs for scalability and quantum resistance

- Implements account abstraction natively for better user experience

- Offers native ETH for gas payments (no separate token required)

- Supports paymaster contracts for gasless transactions

- Provides instant withdrawals without challenge periods

// zkSync Era smart contract with account abstraction

import "@matterlabs/zksync-contracts/l2/system-contracts/interfaces/IAccount.sol";

contract CustomAccount is IAccount {

using TransactionHelper for Transaction;

// Account abstraction allows for custom signature schemes

function validateTransaction(

bytes32 _txHash,

bytes32 _suggestedSignedHash,

Transaction calldata _transaction

) external payable override returns (bytes4 magic) {

// Custom validation logic - could be multisig, social recovery, etc.

magic = ACCOUNT_VALIDATION_SUCCESS_MAGIC;

}

function executeTransaction(

bytes32 _txHash,

bytes32 _suggestedSignedHash,

Transaction calldata _transaction

) external payable override {

address to = address(uint160(_transaction.to));

uint256 value = _transaction.value;

bytes memory data = _transaction.data;

// Execute the transaction

bool success;

assembly {

success := call(gas(), to, value, add(data, 0x20), mload(data), 0, 0)

}

require(success, "Transaction execution failed");

}

}

// Paymaster contract for gasless transactions

contract MyPaymaster is IPaymaster {

function validateAndPayForPaymasterTransaction(

bytes32 _txHash,

bytes32 _suggestedSignedHash,

Transaction calldata _transaction

) external payable override returns (bytes4 magic, bytes memory context) {

// Check if we want to sponsor this transaction

require(_transaction.gasLimit <= 1000000, "Gas limit too high");

// Pay for the transaction

uint256 requiredETH = _transaction.gasLimit * _transaction.maxFeePerGas;

(bool success,) = payable(BOOTLOADER_ADDRESS).call{value: requiredETH}("");

require(success, "Failed to pay for transaction");

magic = PAYMASTER_VALIDATION_SUCCESS_MAGIC;

}

function postTransaction(

bytes calldata _context,

Transaction calldata _transaction,

bytes32 _txHash,

bytes32 _suggestedSignedHash,

ExecutionResult _txResult,

uint256 _maxRefundedGas

) external payable override {

// Post-transaction logic (refunds, logging, etc.)

}

}The account abstraction feature is particularly game-changing. Instead of requiring users to have ETH for gas, paymaster contracts can sponsor transactions. Imagine using a dApp where the application pays for your gas fees - that's the kind of user experience zkSync enables.

Performance Comparison: Real Numbers

Let's talk actual performance metrics because that's what really matters when you're choosing where to deploy your application:

- Transaction throughput: zkSync (~2000 TPS), Arbitrum (~4000 TPS), Optimism (~2000 TPS)

- Gas costs: All achieve 90-95% savings compared to Ethereum mainnet

- Withdrawal times: zkSync (instant), Arbitrum/Optimism (7 days)

- EVM compatibility: Arbitrum/Optimism (100%), zkSync Era (95%+)

- Finality: zkSync (instant), Arbitrum/Optimism (dispute period dependent)

The withdrawal time difference is huge for user experience. If you're building a trading application where users frequently move funds between layers, zkSync's instant withdrawals are a massive advantage. But if you're building a DeFi protocol where users typically stay within the ecosystem, the 7-day wait isn't as critical.

Developer Experience: What It's Really Like

Having deployed contracts on all three networks, I can tell you the developer experience varies significantly. Arbitrum and Optimism feel almost identical to working on Ethereum mainnet. Your existing tooling, testing frameworks, and deployment scripts work without modification.

// Deployment comparison across networks

// hardhat.config.js configuration

module.exports = {

networks: {

arbitrum: {

url: "https://arb1.arbitrum.io/rpc",

accounts: [PRIVATE_KEY],

chainId: 42161,

gasPrice: "auto"

},

optimism: {

url: "https://mainnet.optimism.io",

accounts: [PRIVATE_KEY],

chainId: 10,

gasPrice: "auto"

},

zkSyncEra: {

url: "https://mainnet.era.zksync.io",

accounts: [PRIVATE_KEY],

chainId: 324,

zksync: true, // Special flag for zkSync

ethNetwork: "mainnet"

}

},

// zkSync requires special compiler

zksolc: {

version: "1.3.13",

compilerSource: "binary",

settings: {

optimizer: {

enabled: true,

runs: 200

}

}

}

};

// Gas estimation example

async function estimateGas() {

const contract = await ethers.getContractFactory("MyContract");

// Ethereum mainnet

const ethGasEstimate = await contract.provider.estimateGas({

data: contract.interface.encodeDeploy([])

});

console.log("Ethereum gas:", ethGasEstimate.toString());

// Layer 2 deployments typically cost 5-10% of mainnet

const l2GasEstimate = ethGasEstimate.div(15); // ~93% savings

console.log("L2 estimated gas:", l2GasEstimate.toString());

}zkSync Era requires a bit more setup. You need their custom compiler (zksolc) and some contracts might need minor modifications. But the payoff in terms of features like account abstraction and instant finality often makes it worth the extra effort.

Ecosystem and Adoption Trends

The ecosystem growth has been pretty remarkable. Arbitrum currently leads in Total Value Locked (TVL), with major DeFi protocols like Uniswap, Aave, and Curve deploying there early. Optimism has been gaining ground, especially with Base bringing in a lot of mainstream adoption.

zkSync is interesting because they're seeing rapid growth in payments and consumer applications. The instant finality and account abstraction features make it particularly attractive for applications that need better UX than traditional crypto wallets provide.

We're not just competing with each other - we're all working toward the same goal of making Ethereum more accessible. The real competition is with centralized alternatives and other blockchain ecosystems.

Layer 2 Developer Survey 2024

Future Roadmaps: What's Coming Next

All three networks have exciting developments planned. Arbitrum is working on Stylus, which will allow developers to write smart contracts in languages like Rust and C++. This could dramatically improve performance for compute-intensive applications.

Optimism is focusing on their Superchain vision - a network of interconnected OP Stack chains that can seamlessly communicate with each other. We're already seeing this with Base, but imagine dozens of specialized chains all working together.

zkSync is pushing toward a "hyperchain" ecosystem where anyone can deploy their own zkSync-powered chain. They're also working on making their zkEVM even more compatible with existing Ethereum tooling.

Making the Choice: Which One Should You Choose?

The answer honestly depends on what you're building. If you want the safest, most compatible option with the largest ecosystem, Arbitrum is probably your best bet. It's like choosing the reliable, well-tested option.

If you're building something that benefits from the governance model and public goods funding (or want to use the OP Stack), Optimism makes sense. Plus, the Base integration gives you access to Coinbase's user base.

If you need instant finality, want to experiment with account abstraction, or are building consumer-facing applications where UX is critical, zkSync Era offers the most innovative features.

The good news is that you don't have to choose just one. Many successful projects deploy across multiple Layer 2s to maximize their reach and give users options. The tooling for cross-chain deployment has gotten significantly better, making multi-chain strategies more feasible than ever.

Layer 2 solutions have fundamentally changed how we think about blockchain scalability. What started as a temporary fix for Ethereum's congestion has evolved into a rich ecosystem of specialized chains, each optimizing for different use cases. Whether you're a developer looking to build the next big DeFi protocol or a user tired of paying ridiculous gas fees, there's never been a better time to explore what Layer 2s have to offer.

0 Comment