Picture this: you're about to mint that perfect NFT, your finger hovers over the "confirm" button, and then... BAM! A $50 gas fee for a $10 transaction. Welcome to Ethereum, where sometimes the toll costs more than the journey itself. But before you throw your laptop out the window, let's dive deep into what gas fees actually are and why they're not just Ethereum's way of trolling us.

What Exactly Are Gas Fees? (Spoiler: It's Not About Your Car)

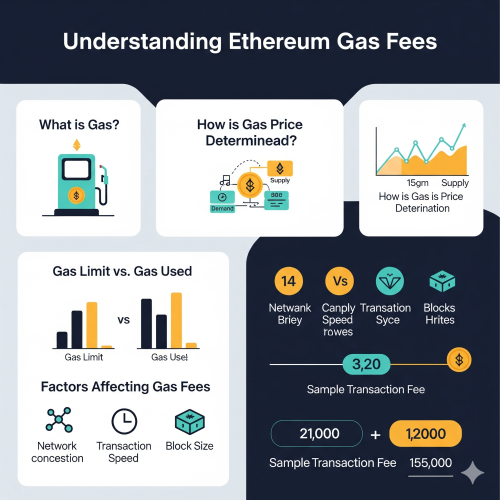

Gas fees are essentially the cost of doing business on the Ethereum blockchain. Think of Ethereum as a massive, distributed computer where thousands of nodes work together to process transactions. Just like how your laptop heats up when running intensive software, the Ethereum network requires computational energy to execute smart contracts and process transactions.

Gas is the unit that measures this computational work. Every operation on Ethereum - whether it's sending ETH, swapping tokens on Uniswap, or minting an NFT - requires a certain amount of gas. The gas fee is what you pay miners (or validators, post-merge) to prioritize and include your transaction in a block.

The Anatomy of Gas Fees: Breaking Down the Numbers

Gas fees aren't just random numbers thrown at you by the blockchain gods. There's actually a method to this madness. Let's break down the key components:

- Base Fee: The minimum cost per unit of gas, burned and removed from circulation

- Priority Fee (Tip): Extra payment to incentivize miners to process your transaction faster

- Gas Limit: Maximum amount of gas you're willing to spend on a transaction

- Gas Used: Actual amount of gas consumed by your transaction

The total gas fee is calculated as: (Base Fee + Priority Fee) × Gas Used. Simple math, but the implications can be wallet-draining when the network gets congested.

Why Do Gas Fees Fluctuate Like Crypto Prices?

If you've been in the Ethereum space for more than five minutes, you've probably noticed that gas fees have more mood swings than a teenager. One minute you're paying $5 for a transaction, the next it's $100. This volatility comes down to supply and demand economics.

Ethereum can only process about 15 transactions per second. When demand spikes - maybe because of a hot NFT drop or a DeFi protocol going viral - users start bidding higher gas fees to get their transactions processed first. It's like an auction where everyone's trying to cut in line, and the auctioneer (the network) goes to the highest bidder.

Gas fees are the free market's way of allocating scarce block space. When everyone wants to transact at the same time, prices go up. It's economics 101, but with more blockchain and frustration.

Ethereum Community Wisdom

EIP-1559: The London Upgrade That Changed Everything

In August 2021, Ethereum implemented EIP-1559, which fundamentally changed how gas fees work. Before this upgrade, gas fees were a wild west auction system. After EIP-1559, the system became more predictable with the introduction of base fees and priority fees.

The base fee gets burned (permanently removed from circulation), making ETH deflationary during high network usage. The priority fee goes to miners as a tip. This system made gas fee estimation more reliable, though it didn't necessarily make fees cheaper - that's a job for scaling solutions.

Smart Contract Gas Consumption: Not All Code Is Created Equal

Different operations on Ethereum consume different amounts of gas. A simple ETH transfer might cost 21,000 gas, while a complex DeFi transaction involving multiple smart contracts could cost 500,000 gas or more. Let's look at some code examples:

// Simple ETH transfer - approximately 21,000 gas

function transferETH(address payable recipient) public payable {

recipient.transfer(msg.value);

}

// ERC-20 token transfer - approximately 65,000 gas

function transfer(address to, uint256 amount) public returns (bool) {

require(balanceOf[msg.sender] >= amount, "Insufficient balance");

balanceOf[msg.sender] -= amount;

balanceOf[to] += amount;

emit Transfer(msg.sender, to, amount);

return true;

}

// Complex DeFi operation - can be 200,000+ gas

function swapAndStake(

address tokenA,

address tokenB,

uint256 amount,

address stakingContract

) public {

// Swap tokens on DEX

IERC20(tokenA).transferFrom(msg.sender, address(this), amount);

uint256 received = IDex(dexContract).swap(tokenA, tokenB, amount);

// Approve staking contract

IERC20(tokenB).approve(stakingContract, received);

// Stake tokens

IStaking(stakingContract).stake(received);

// Mint receipt token

_mint(msg.sender, received);

}

Gas Optimization: Making Your Code Wallet-Friendly

Writing gas-efficient smart contracts is both an art and a science. Here are some techniques developers use to minimize gas costs:

- Use `uint256` instead of smaller integer types (Ethereum's virtual machine is optimized for 256-bit operations)

- Pack struct variables efficiently to minimize storage slots

- Use `calldata` instead of `memory` for function parameters when possible

- Implement batch operations to amortize fixed costs across multiple actions

- Cache storage variables in memory for repeated access

// Gas-inefficient version

contract BadExample {

mapping(address => uint256) public balances;

function updateBalances(address[] memory users, uint256[] memory amounts) public {

for(uint i = 0; i < users.length; i++) {

balances[users[i]] = amounts[i]; // Multiple storage writes

}

}

}

// Gas-optimized version

contract GoodExample {

mapping(address => uint256) public balances;

function updateBalances(address[] calldata users, uint256[] calldata amounts) public {

uint256 length = users.length; // Cache array length

for(uint256 i = 0; i < length; ) {

balances[users[i]] = amounts[i];

unchecked { ++i; } // Save gas on overflow checks

}

}

// Batch multiple operations

function batchTransfer(address[] calldata recipients, uint256[] calldata amounts) external {

uint256 totalAmount = 0;

uint256 length = recipients.length;

// Calculate total first

for(uint256 i = 0; i < length; ) {

totalAmount += amounts[i];

unchecked { ++i; }

}

require(balances[msg.sender] >= totalAmount, "Insufficient balance");

balances[msg.sender] -= totalAmount; // Single storage update

// Update recipients

for(uint256 i = 0; i < length; ) {

balances[recipients[i]] += amounts[i];

unchecked { ++i; }

}

}

}

Layer 2 Solutions: The Light at the End of the Gas Fee Tunnel

While we wait for Ethereum 2.0 to fully roll out, Layer 2 solutions are providing immediate relief from high gas fees. These solutions process transactions off the main Ethereum chain and then batch them together for final settlement on Layer 1.

Popular Layer 2s like Polygon, Arbitrum, and Optimism offer transaction costs that are often 100x cheaper than mainnet Ethereum. The trade-off? You need to bridge your assets to these networks, and not all dApps are available on every Layer 2.

Gas Fee Strategies: Timing Is Everything

Smart users have learned to game the gas fee system. Network activity follows predictable patterns - fees are typically lower on weekends and during off-peak hours (US nighttime). Tools like GasTracker and ETH Gas Station help users monitor current gas prices and set appropriate fees.

The key to surviving high gas fees is patience and timing. Unless you're arbitraging or in a time-sensitive situation, waiting for lower gas prices can save you significant money in the long run.

DeFi Veteran Advice

The Future of Gas Fees: What's Coming Next?

Ethereum's transition to Proof of Stake was just the beginning. The roadmap includes sharding, which will dramatically increase the network's transaction throughput. Additionally, advancements in Layer 2 technology and the potential for "proto-danksharding" could make gas fees a thing of the past.

EIP-4844, also known as "proto-danksharding," introduces a new type of transaction that carries large amounts of data that can be used by Layer 2 networks. This could reduce Layer 2 costs by 10-100x, making Ethereum truly accessible for everyday use.

Gas fees might seem like an annoying tax on using Ethereum, but they serve a crucial purpose in maintaining network security and preventing spam. Understanding how they work, when they spike, and how to minimize them is essential for anyone serious about participating in the Ethereum ecosystem. The future looks bright with scaling solutions on the horizon, but until then, we're all just trying to time the market - both for our investments and our transaction fees.

Remember, every time you pay a gas fee, you're not just moving money or tokens - you're participating in a global, decentralized computer that's reshaping how we think about finance, ownership, and digital interactions. That perspective might not make the fees hurt less, but at least you're part of something revolutionary. And hey, at least it's not as expensive as San Francisco parking fees... yet.

0 Comment