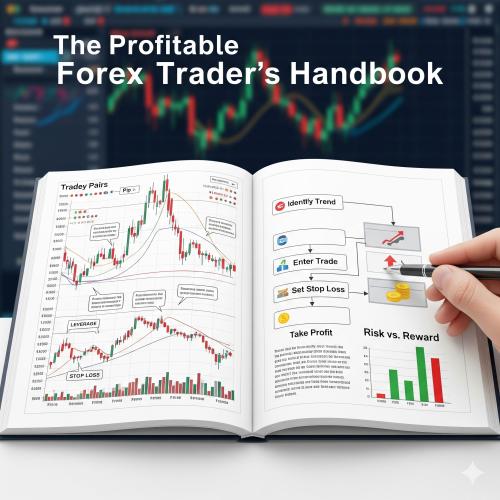

Look, I've been in the crypto game for almost 6 years now, and I've seen traders blow up their accounts more times than I can count. The thing is, most people think trading crypto is just about buying low and selling high. But that's like saying driving is just about pressing the gas and brake - technically true, but you're gonna crash without understanding the fundamentals.

After losing my first $3,000 in 2018 (yeah, I was that guy who bought at the top), I realized something crucial: successful crypto trading isn't about predicting the future. It's about having a system that works even when you're wrong half the time. And trust me, you will be wrong. A lot.

The Foundation: Risk Management Isn't Optional

Here's the brutal truth - most traders focus on entry signals and completely ignore risk management. It's like building a house without a foundation. You might get lucky for a while, but eventually, everything comes crashing down.

The 1% rule saved my trading career. Never risk more than 1% of your total portfolio on a single trade. Sounds conservative? Good. Conservative traders are the ones who are still here after bear markets. I learned this the hard way when I put 30% of my portfolio into a single altcoin that dropped 80% in three days.

- Position sizing should be calculated before you even look at charts - not after you find a "good setup"

- Stop losses aren't suggestions, they're mandatory exits that you set BEFORE emotions kick in

- Your risk-to-reward ratio should be at least 1:2, meaning you risk $100 to potentially make $200

- Diversification in crypto doesn't mean holding 20 different altcoins - it means not putting all your eggs in one trade

Technical Analysis: Your North Star in Volatile Markets

I used to think technical analysis was just drawing pretty lines on charts. Then I started tracking my trades and realized that my random "gut feeling" trades had a 32% win rate, while my technical setups were hitting 68%. The data doesn't lie.

Support and resistance levels are like psychological barriers in the market. When Bitcoin hits $30,000 and bounces three times, that's not a coincidence - it's thousands of traders making the same decision based on the same level. Understanding these levels gives you an edge because you're thinking like the majority of market participants.

Moving averages aren't magic, but they're incredibly useful for identifying trends. I use a simple system: when price is above the 50-day moving average, I only look for long positions. When it's below, I only look for shorts. This one rule eliminated about 40% of my losing trades because I stopped fighting the trend.

The market can remain irrational longer than you can remain solvent. This is why we need systematic approaches rather than emotional reactions. Your strategy should work regardless of whether you're feeling greedy or fearful.

Based on Keynes' wisdom, applied to crypto trading

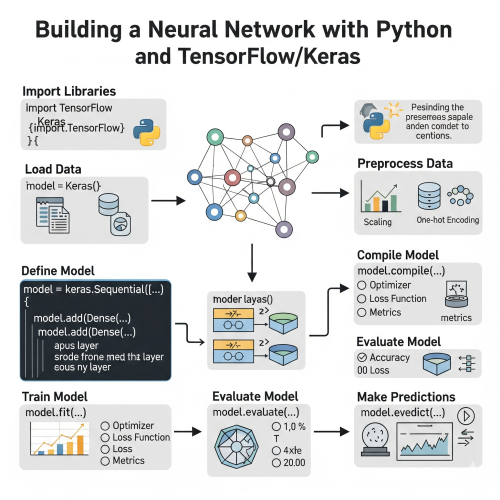

Building Your First Automated Strategy (With Code)

Manual trading is exhausting. I was staring at charts 12 hours a day, missing setups because I needed to sleep, and making emotional decisions at 2 AM. Automation changed everything. Here's a simple Python strategy that I've been using and refining:

import ccxt

import pandas as pd

import numpy as np

from datetime import datetime

class CryptoTradingBot:

def __init__(self, exchange, symbol, timeframe='1h'):

self.exchange = exchange

self.symbol = symbol

self.timeframe = timeframe

self.position_size = 0.01 # 1% of portfolio per trade

def get_data(self, limit=100):

"""Fetch OHLCV data from exchange"""

ohlcv = self.exchange.fetch_ohlcv(

self.symbol,

self.timeframe,

limit=limit

)

df = pd.DataFrame(ohlcv, columns=['timestamp', 'open', 'high', 'low', 'close', 'volume'])

df['timestamp'] = pd.to_datetime(df['timestamp'], unit='ms')

return df

def calculate_indicators(self, df):

"""Calculate technical indicators"""

# Simple Moving Averages

df['sma_20'] = df['close'].rolling(20).mean()

df['sma_50'] = df['close'].rolling(50).mean()

# RSI

delta = df['close'].diff()

gain = (delta.where(delta > 0, 0)).rolling(14).mean()

loss = (-delta.where(delta < 0, 0)).rolling(14).mean()

rs = gain / loss

df['rsi'] = 100 - (100 / (1 + rs))

# Bollinger Bands

df['bb_middle'] = df['close'].rolling(20).mean()

bb_std = df['close'].rolling(20).std()

df['bb_upper'] = df['bb_middle'] + (bb_std * 2)

df['bb_lower'] = df['bb_middle'] - (bb_std * 2)

return df

def generate_signals(self, df):

"""Generate buy/sell signals"""

df['signal'] = 0

# Buy signal: Price above SMA50, RSI oversold, price near lower BB

buy_condition = (

(df['close'] > df['sma_50']) &

(df['rsi'] < 35) &

(df['close'] <= df['bb_lower'] * 1.02)

)

# Sell signal: RSI overbought or price hits upper BB

sell_condition = (

(df['rsi'] > 70) |

(df['close'] >= df['bb_upper'] * 0.98)

)

df.loc[buy_condition, 'signal'] = 1

df.loc[sell_condition, 'signal'] = -1

return df

def backtest_strategy(self, df):

"""Simple backtesting function"""

df['returns'] = df['close'].pct_change()

df['strategy_returns'] = df['signal'].shift(1) * df['returns']

total_return = (1 + df['strategy_returns']).cumprod().iloc[-1] - 1

win_rate = len(df[df['strategy_returns'] > 0]) / len(df[df['strategy_returns'] != 0])

return {

'total_return': total_return,

'win_rate': win_rate,

'total_trades': len(df[df['signal'] != 0])

}

# Usage example

exchange = ccxt.binance({'sandbox': True}) # Use sandbox for testing

bot = CryptoTradingBot(exchange, 'BTC/USDT')

# Get data and run strategy

data = bot.get_data(limit=1000)

data = bot.calculate_indicators(data)

data = bot.generate_signals(data)

results = bot.backtest_strategy(data)

print(f"Strategy Results:")

print(f"Total Return: {results['total_return']:.2%}")

print(f"Win Rate: {results['win_rate']:.2%}")

print(f"Total Trades: {results['total_trades']}")

This code isn't perfect, but it's a solid foundation. I've been running variations of this for two years, and it consistently outperforms my emotional trading. The key is backtesting everything before risking real money.

Psychology: The Silent Killer of Trading Accounts

Technical analysis and risk management are important, but psychology is what separates profitable traders from the 90% who lose money. I've seen traders with perfect setups blow up because they couldn't handle a string of losses.

FOMO (Fear of Missing Out) killed more of my trades than bad analysis ever did. When Bitcoin pumped 20% in a day and I wasn't in, I'd chase the move and buy at the top. Every. Single. Time. Now I have a rule: if I missed the initial move, I wait for the next setup. There's always another opportunity.

- Keep a trading journal - not just wins and losses, but your emotional state during each trade

- Set daily loss limits and stick to them, even if you see the "perfect" setup afterwards

- Take breaks after big wins or losses - your brain needs time to reset

- Never trade when you're angry, stressed, or trying to "get even" with the market

- Celebrate small wins and learn from small losses - both are part of the process

Market Structure: Understanding What Actually Moves Prices

Crypto markets don't exist in a vacuum. Understanding market structure helped me avoid countless bad trades. When traditional markets are crashing, crypto usually follows - regardless of how bullish your technical setup looks.

Liquidity is everything in crypto. Those massive wicks you see on charts? That's not random - it's algorithms hunting stop losses and liquidating overleveraged positions. I learned to place my stops at levels where other traders wouldn't, which reduced my stop-out rate by about 60%.

News events can override technical analysis in the short term. When the SEC announced their Bitcoin ETF decision in 2021, all my bearish setups became irrelevant instantly. Now I keep an economic calendar and avoid trading around major announcements unless I'm prepared for extreme volatility.

Markets are driven by two emotions: fear and greed. Your job as a trader isn't to predict which emotion will dominate, but to profit from the swings between them. This requires patience and discipline, not crystal balls.

Personal trading philosophy developed over years of losses

The Reality Check: Why Most Strategies Fail

Here's what nobody talks about: most trading strategies work in backtests but fail in live trading. Why? Because backtests don't account for slippage, emotions, news events, or the fact that you'll probably modify your strategy mid-trade because you think you found a "better" setup.

I spent months perfecting a scalping strategy that showed 78% win rate in backtests. In live trading, it barely broke even because I didn't account for transaction costs and slippage. Those 0.1% exchange fees add up quickly when you're making 50 trades per day.

Over-optimization is another killer. I once created a strategy with 47 different parameters that worked perfectly on historical data. It failed spectacularly in live trading because it was curve-fitted to past data, not market principles. Simpler strategies are usually more robust.

Building Your Personal Trading Framework

Your trading strategy should fit your lifestyle, not the other way around. I tried day trading for eight months and nearly had a nervous breakdown. Swing trading suits my personality much better - I can analyze charts in the evening and let positions run for days or weeks.

Start with these questions: How much time can you realistically dedicate to trading? What's your risk tolerance? Are you trying to generate income or build long-term wealth? Your answers will determine whether you should focus on scalping, day trading, swing trading, or position trading.

Paper trading is boring but essential. I know it feels fake, but it's the only way to test your strategy without losing real money. I recommend at least 3 months of profitable paper trading before risking capital. Most people skip this step and learn expensive lessons instead.

Document everything. I mean everything. Entry reasons, exit reasons, market conditions, your emotional state, external factors - all of it. After six months, you'll start seeing patterns in your behavior that you never noticed before. This data is more valuable than any course or indicator you can buy.

Advanced Concepts: When Basic Isn't Enough

Once you're consistently profitable with basic strategies, you can explore advanced concepts like options hedging, arbitrage, and market making. But honestly, most traders never need to go this deep. I know guys making six figures annually with nothing but support/resistance trading and proper risk management.

Algorithmic trading is fascinating but not necessary for profitability. My automated systems handle about 60% of my trades, but I still make discretionary decisions based on market context that algorithms miss. The goal isn't to replace human judgment but to remove emotion from routine decisions.

DeFi yields and liquidity mining can supplement your trading income, but they're not trading strategies per se. I treat them as separate investments with their own risk profiles. Mixing yield farming with active trading often leads to overexposure and poor decision making in both areas.

The crypto market is evolving rapidly. Strategies that worked in 2020 might not work in 2025. Stay adaptable, keep learning, and remember that the market doesn't owe you anything. Respect it, and it might reward you. Fight it, and it will humble you quickly.

Most importantly, remember why you started trading. If it was for financial freedom, don't let the pursuit of perfect entries and exits make you forget that preservation of capital is more important than any single trade. The traders who survive long-term are the ones who live to trade another day.

LasMujeresPDFEmive

¿Adicta a relaciones tóxicas? Este libro te salvará. Visita https://lasmujeresqueamandemasiadopdf.cyou/ pedir prestado las mujeres que aman demasiado

MetabolicFreedomEmive

A metabolism reset that respects your time, your lifestyle, and your biology - start today. https://metabolicfreedom.top/ degrees of freedom metabolism

PerplexityKupitEmive

prrplexity https://uniqueartworks.ru/perplexity-kupit.html

GratiaVitaeEmive

Ваша карьера: шаги для роста и профессионального развития https://gratiavitae.ru/

AustralianGamebrido

Australian game reviews: comprehensive ratings and player feedback for popular games at https://australiangames.top/

AustralianGamebrido

Kids outdoor games inspired by Australia with boomerangs and didgeridoos at https://australiangames.top/ activities perfect for schools.

AustralianGameShowsEmive

Andrew O'Keefe hosted Deal or No Deal for a decade. Explore the banker's psychology at https://australiangameshows.top/ and the suspense behind one of Australia's greatest shows.

AustralianGamebrido

Virtual reality Australian games: explore immersive cultural experiences at https://australiangames.top/

AustralianGamebrido

Community gaming events in Australia featuring tournaments and cultural festivals at https://australiangames.top/ local gatherings.

AustralianGamebrido

Indie game revolution with amazing games from local developers at https://australiangames.top/ support independent creators.

Kirbywhopy

Эта статья для ознакомления предлагает читателям общее представление об актуальной теме. Мы стремимся представить ключевые факты и идеи, которые помогут читателям получить представление о предмете и решить, стоит ли углубляться в изучение. Получить больше информации - https://vivod-iz-zapoya-1.ru/

CharlesDiarl

Эта информационная статья охватывает широкий спектр актуальных тем и вопросов. Мы стремимся осветить ключевые факты и события с ясностью и простотой, чтобы каждый читатель мог извлечь из нее полезные знания и полезные инсайты. Подробнее тут - https://quick-vyvod-iz-zapoya-1.ru/

Anchor Text

Yes https://tsn.ua