Let's be real—everyone wants to “beat the market.” But crypto is wild, unpredictable, and sometimes, it feels like the charts are making fun of you. Still, with some structure, discipline, and a little bit of code, you can get a lot closer to the dream of a profitable trading strategy. In this guide, we're going to dig into the practical side of building a crypto trading strategy from scratch—no fluff, just what actually works. We'll get a little technical, show some code, and give you honest, human advice along the way.

Why Do You Even Need a Strategy?

If you’re trading crypto without a strategy, you’re basically just gambling—and the house always wins. Sure, you might get lucky once or twice, but consistent profits come with planning, testing, and sticking to your rules. Plus, a strategy helps you manage risk, stay sane when the market does something crazy, and avoid emotional mistakes.

“Having no trading strategy is like sailing without a compass—you might move, but you’re lost.”

Some trader who learned the hard way

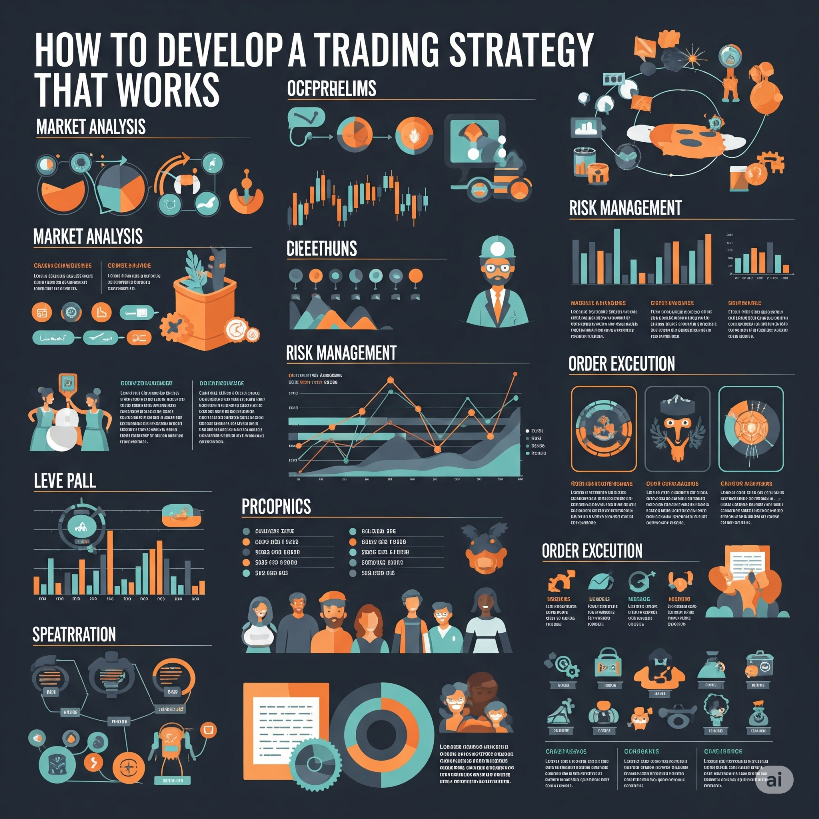

Core Elements of a Good Crypto Trading Strategy

- Entry Criteria: When to get in (buy/short)

- Exit Criteria: When to get out (sell/cover)

- Risk Management: How much to risk per trade

- Position Sizing: How big your trades are

- Backtesting: Testing your strategy on historical data

- Discipline: Actually following your rules, every time

Step 1: Choose Your Trading Style

Are you a day trader, swing trader, or long-term HODLer? Your strategy needs to fit your lifestyle and personality. If you can't sit in front of a screen all day, don't try to scalp 1-minute candles.

- Day Trading: Short-term, lots of trades, high stress

- Swing Trading: Hold positions for days/weeks, less stressful

- Position Trading: Long-term, few trades, macro trends

Photo by M. B. M. on Unsplash

Photo by Brooke Cagle on Unsplash

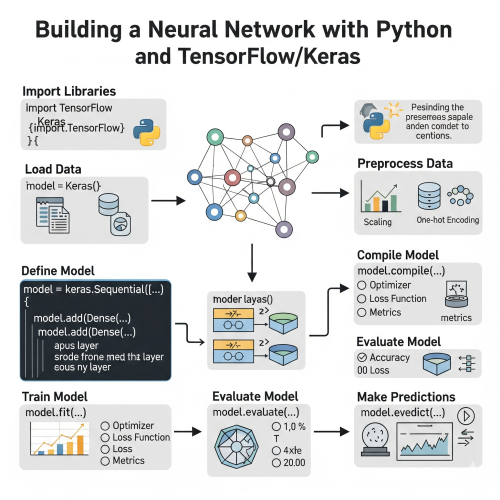

Step 2: Pick Your Indicators and Signals

Indicators are tools that help you make decisions. Most traders use a combination of technical indicators (like RSI, moving averages, MACD) and sometimes fundamental factors (like on-chain data or news). Don’t go overboard—a simple system beats a complicated one you don’t understand.

Let's say you want to use the 50-period and 200-period moving average crossover (a classic).

# Example: Python code for moving average crossover on historical BTC data import pandas as pd # Assume you have a DataFrame with 'close' prices df['ma50'] = df['close'].rolling(window=50).mean() df['ma200'] = df['close'].rolling(window=200).mean() # Buy signal: 50MA crosses above 200MA df['signal'] = 0 df.loc[df['ma50'] > df['ma200'], 'signal'] = 1 df.loc[df['ma50'] < df['ma200'], 'signal'] = -1

This is the backbone of tons of strategies. You can add filters (like only trade when RSI confirms), but don’t make it too complex.

Step 3: Define Your Entry and Exit Rules

Be specific! Don’t use “enter when it looks bullish.” Use clear, testable rules, for example:

- Enter long when 50MA crosses above 200MA and RSI > 50

- Exit when 50MA crosses below 200MA or RSI < 40

- Set stop loss at 2% below entry price

- Take profit at 5% gain

You can automate this logic with code, or at least write it on paper and stick to it. Automation helps you avoid emotional decisions.

Step 4: Backtest — Don’t Skip This!

Backtesting is running your strategy on historical data to see how it would have performed. It's not a guarantee of future results, but it tells you if your idea is garbage or not.

# Backtest: Calculate returns based on your signals

df['returns'] = df['close'].pct_change()

df['strategy_returns'] = df['returns'] * df['signal'].shift(1)

cumulative_strategy = (1 + df['strategy_returns']).cumprod() - 1

print(f"Cumulative strategy return: {cumulative_strategy.iloc[-1]:.2%}")

Use libraries like Backtrader or QuantConnect for more advanced backtesting.

Step 5: Risk Management (Don’t Blow Up!)

This is where most people mess up. Never risk more than you can afford to lose. Here are some rules to live by:

- Risk only 1-2% of your capital per trade

- Set stop losses, always

- Don’t chase losses with bigger bets

- Review your trades and learn from mistakes

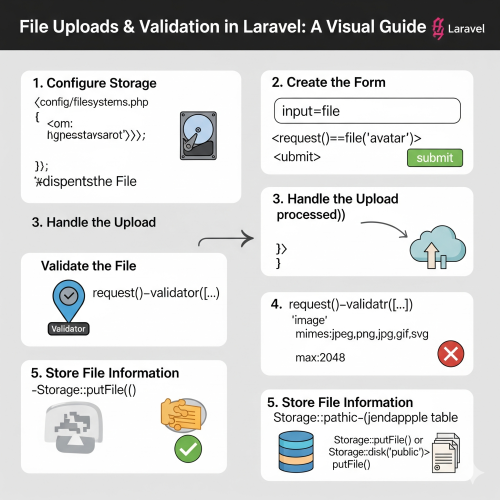

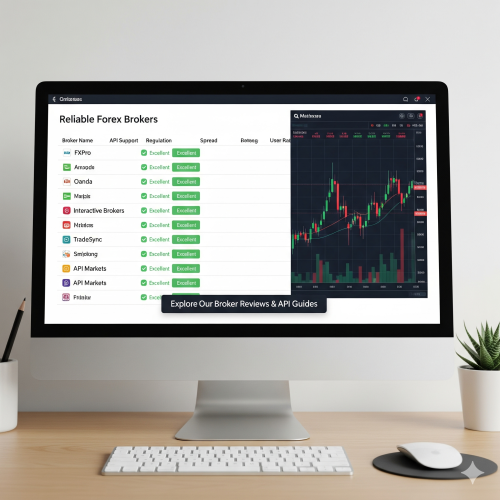

Step 6: Automate (If You Can)

If you’re comfortable coding, automate your strategy with Python using an exchange’s API

(like Binance or Coinbase Pro). Here’s a very basic skeleton using ccxt:

import ccxt

exchange = ccxt.binance({

'apiKey': 'YOUR_API_KEY',

'secret': 'YOUR_SECRET',

})

symbol = 'BTC/USDT'

balance = exchange.fetch_balance()

ticker = exchange.fetch_ticker(symbol)

# Example: Place a market buy order (be careful!)

order = exchange.create_market_buy_order(symbol, 0.001)

print(order)

Don’t run this code with your real keys until you know what you’re doing. Test in a sandbox or with small amounts!

Step 7: Track Performance & Iterate

Keep a trading journal. Write down every trade, what you were thinking, and how it worked out. Over time, you’ll see patterns in your behavior and strategy that you can improve.

- Did you stick to your rules?

- What went well? What went wrong?

- How can you make your strategy better without over-complicating it?

A Final Word: No Strategy Works Forever

Markets change. Don’t get married to one strategy. Regularly review and tweak your approach as market conditions evolve.

“The goal is not to be right all the time, but to make money when you are right and lose little when you are wrong.”

Every wise trader, ever

Don’t let perfectionism or fear of failure stop you. Build, test, learn, adjust, and repeat. Good luck out there!

Have questions or want to share your own strategy? Drop a comment below—let’s learn together!

0 Comment