Look, I'm gonna be straight with you – airdrop hunting in 2025 isn't the same wild west it was back in 2021 when people were literally getting rich off clicking a few buttons. The game has evolved, the competition is fierce, and frankly, most people are doing it completely wrong. But here's the thing: there's still serious money to be made if you know what you're doing.

I've been in this space since the early DeFi days, and I've seen people make anywhere from a few hundred bucks to life-changing amounts (I'm talking six figures) from airdrops. I've also seen way more people waste months of their time chasing dead ends. So let me save you some heartache and show you how to actually hunt airdrops that are worth your time in 2025.

The Airdrop Landscape Has Completely Changed

First things first – forget everything you think you know about airdrop hunting from 2021-2022. Those days of spinning up 50 wallets and farming every protocol under the sun? That's not just ineffective now, it's actually counterproductive. Projects have gotten way smarter about detecting sybil attacks and farming behavior.

The protocols that are dropping tokens now are looking for genuine users, not farmers. They want people who actually understand their product, provide real value to the ecosystem, and stick around after the airdrop. This means your strategy needs to be completely different.

Quality Over Quantity: The New Airdrop Meta

Here's what most people get wrong – they're still playing the numbers game. They think if they interact with 100 protocols, they'll hit 5-10 airdrops. Wrong. In 2025, you're better off deeply engaging with 10-15 high-potential protocols than superficially touching 100.

The protocols worth hunting now are looking at metrics like:

- How long you've been using their platform (they can see your first transaction date)

- The diversity of your interactions (not just swaps, but liquidity provision, governance participation, etc.)

- Your transaction patterns (regular usage over months, not burst activity right before a potential airdrop)

- Your wallet "reputation" (age, transaction history, interactions with other legitimate protocols)

- Whether you stick around and continue using the protocol after major announcements

The Sectors That Are Actually Dropping Tokens

Not all sectors are created equal when it comes to airdrops. Based on what I'm seeing in 2025, here's where the real opportunities are:

Layer 2 Solutions: This is still the biggest category. New L2s need users and liquidity, so they're incentivized to reward early adopters. The key is getting in early on chains that haven't launched tokens yet but have serious backing and growing ecosystems.

Intent-Based Protocols: This is the hot new thing. Protocols that abstract away the complexity of DeFi interactions are getting massive funding and need users to test their systems. Think about platforms that let you express an intent ("I want to swap 1000 USDC for ETH at the best price across all chains") and they handle the execution.

Restaking and Liquid Staking: With Ethereum's evolution, anything related to staking derivatives and restaking protocols is hot. These protocols have real revenue models and strong incentives to distribute governance tokens.

The best airdrops in 2025 aren't coming from protocols that need users – they're coming from protocols that need specific types of high-value users. Be that user.

Anonymous DeFi Whale

Your Airdrop Hunting Toolkit

Alright, let's get practical. Here's what you actually need to be successful at this:

Wallet Strategy: Don't use one wallet for everything, but don't go crazy with 50 wallets either. I recommend 2-3 "main" wallets with legitimate transaction history and maybe 2-3 "testing" wallets for newer, riskier protocols. Each main wallet should have a clear identity – one for DeFi power user activities, one for NFTs and gaming, etc.

Capital Requirements: You need money to make money in airdrop hunting now. I'd say minimum $5K per wallet you're seriously farming with, and ideally $20K+ if you want to be considered a "high-value user" by most protocols. I know that's a lot, but this isn't 2021 anymore.

Time Investment: Plan to spend 2-3 hours per week researching new protocols, checking your positions, and making transactions. This isn't passive income – it's a part-time job if you want to do it right.

The Protocols I'm Watching in 2025

I can't give you financial advice, but I can tell you what I'm personally keeping an eye on. Remember, by the time something is "obvious," it's probably too late for the best rewards.

Hyperlane: Interoperability infrastructure that's getting serious traction. They're powering cross-chain applications and haven't launched a token yet. I've been using their bridge and seeing more protocols integrate with them.

EigenLayer Ecosystem: Not EigenLayer itself (that's already happened), but the protocols building on top of it. Restaking is going to be huge, and the applications layer needs users.

Intent-Based DEXs: There are several in development that are solving real UX problems. The ones with serious backing and innovative approaches to MEV protection are worth watching.

But here's the thing – don't just ape into everything I mention. Do your own research, understand what these protocols actually do, and only use them if you genuinely see value in the product.

Common Mistakes That Will Kill Your Airdrop Dreams

I see people making the same mistakes over and over. Here's what NOT to do:

Farming Too Obviously: If you create a wallet and immediately start hitting every protocol with the exact same transaction amounts, you're getting flagged. Protocols can see these patterns easily now.

Ignoring Gas Costs: I've seen people spend $2000 in gas fees chasing a $300 airdrop. Always factor in your costs and make sure the potential reward justifies the expense.

Not Having an Exit Strategy: When you get an airdrop, have a plan. Are you selling immediately? Holding for governance? Providing liquidity? Don't just let tokens sit in your wallet because you can't decide.

The Advanced Tactics Nobody Talks About

Once you've got the basics down, here are some advanced strategies that can set you apart:

Governance Participation: Many protocols weight their airdrops based on governance activity. If there's a governance token, hold some and vote on proposals. Even if the airdrop doesn't materialize, you're building reputation across the ecosystem.

Community Involvement: Join Discord servers, contribute to discussions, provide feedback. Some protocols specifically reward community members who help improve the product. This takes time, but the rewards can be substantial.

Cross-Protocol Synergies: Look for protocols that work together or are built by the same teams. Sometimes using one protocol makes you eligible for airdrops from related projects.

The biggest airdrop winners I know aren't just farmers – they're people who genuinely engage with the crypto ecosystem and contribute value. The money follows naturally.

DeFi Protocol Founder

Managing Risk and Expectations

Let's be real about the risks here. Smart contract risk is always present – I've lost money to protocol hacks while airdrop hunting. Only use money you can afford to lose.

There's also opportunity cost. The time and capital you spend hunting airdrops could potentially be better invested elsewhere. I generally tell people that if you're not making at least a 20% annual return from your airdrop hunting (factoring in all costs and time), you should probably just buy and hold good projects instead.

The regulatory landscape is also evolving. Some airdrops might have tax implications you haven't considered, and some protocols are getting more careful about who they distribute tokens to based on geography.

Tools and Resources You Actually Need

Here's my actual toolkit (no affiliate links, just what I use):

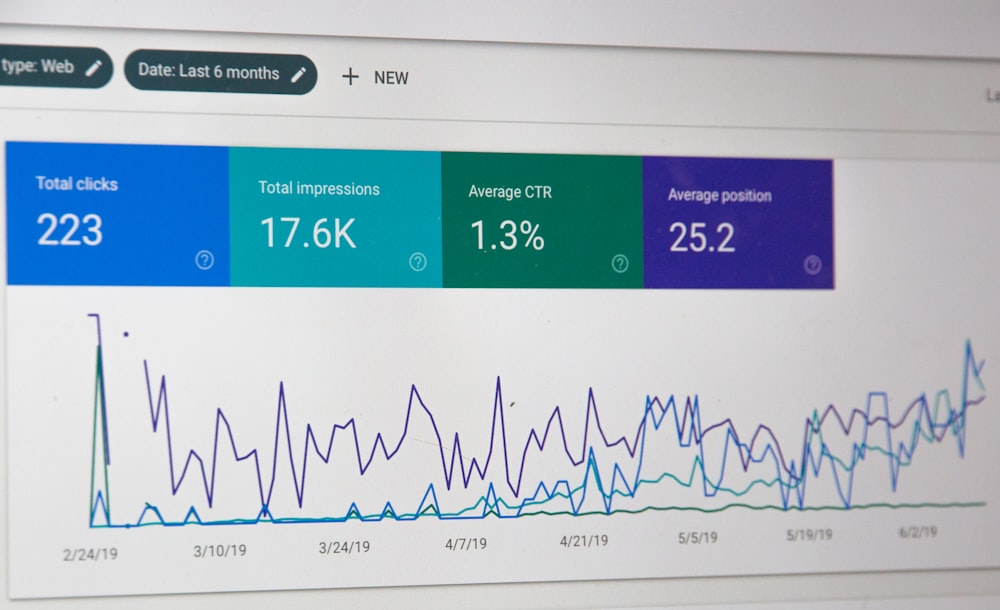

- DeBank: For tracking your DeFi positions across chains and protocols

- Dune Analytics: For researching protocol metrics and user behavior

- Twitter Lists: Follow the right people and stay updated on protocol developments

- Discord/Telegram: Most alpha still happens in community chats

- Zapper or Zerion: For portfolio management and discovery of new protocols

Don't overcomplicate it with too many tools. The information advantage in crypto comes from being early, not from having the most sophisticated dashboard.

The Long Game: Building a Sustainable Strategy

The best airdrop hunters I know aren't just chasing the next drop – they're building long-term relationships with the ecosystem. They become power users of protocols they believe in, they contribute to communities, and they build reputations as valuable participants.

This approach has several advantages. First, you're more likely to qualify for the best airdrops because protocols want to reward genuine users. Second, you actually learn about the projects you're using, which makes you a better investor overall. Third, you build a network of relationships that can lead to opportunities beyond just airdrops.

The crypto space rewards people who add value over the long term. If you approach airdrop hunting with that mindset, you'll do much better than people who are just trying to extract value from every protocol they touch.

Remember, the goal isn't to hit every airdrop – it's to build a sustainable strategy that generates consistent returns while you learn about and contribute to the future of finance. The best airdrops are just a bonus on top of that foundation.

So that's my take on airdrop hunting in 2025. It's harder than it used to be, but the rewards for doing it right are still substantial. Just don't expect to get rich quick, and always remember that there are no guarantees in this space. But if you're willing to put in the work and take a thoughtful approach, there's still money to be made.

0 Comment